Equity Can Make Your Move Possible When Affordability Is Tight [INFOGRAPHIC]

Some Highlights

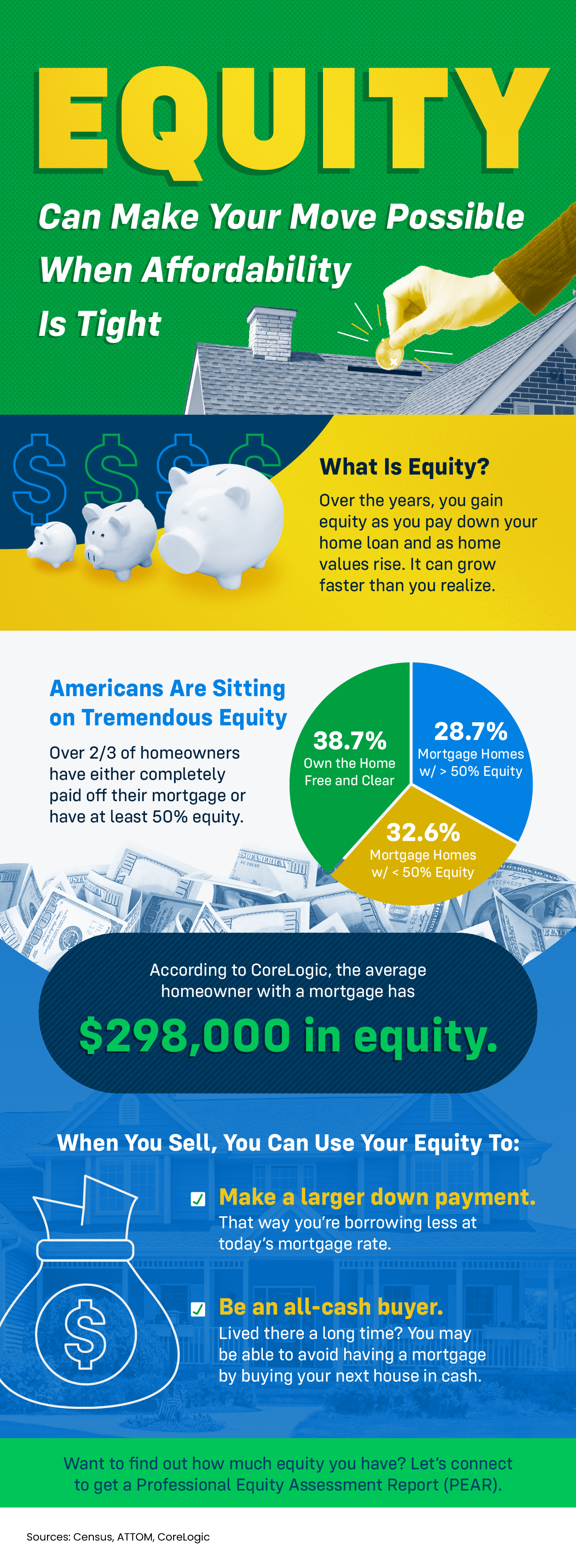

- Did you know the equity you have in your current house can help make your move possible?

- Once you sell, you can use it for a larger down payment on your next home, so you’re borrowing less. Or, you may even have enough to be an all-cash buyer.

- The typical homeowner has $298,000 in equity. If you want to find out how much you have, connect with a local real estate agent for a Professional Equity Assessment Report.

Categories

Recent Posts

Real Estate Still Holds the Title of Best Long-Term Investment

What To Do When Your House Didn’t Sell

![Housing Market Forecast for the 2nd Half of 2024 [INFOGRAPHIC]](https://img.chime.me/image/fs/chimeblog/20240629/16/w600_original_d3c502c0-1460-47ee-9efd-eff9b898c79d-png.webp)

Housing Market Forecast for the 2nd Half of 2024 [INFOGRAPHIC]

The Difference Between an Inspection and an Appraisal

Focus on Time in the Market, Not Timing the Market

How Long Will It Take To Sell My House?

Housing Market Forecast: What’s Ahead for the 2nd Half of 2024

The Downsides of Selling Your House Without an Agent

Why a Vacation Home Is the Ultimate Summer Upgrade

What You Need To Know About Today’s Down Payment Programs

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "

15169 N. Scottsdale Rd. Ste. 205, Scottsdale, Arizona, 85260, USA